Resources

Why Senior loans today?

A unique combination of appealing characteristics

| 1. High Income | – Potential for consistent monthly income and strong risk-adjusted returns – Strong relative value: – US Loan Yield to 3yr: 4.80% |

| 2. Floating Rate Feature | – Effective duration of 0 years, no interest rate risk – “Pure” credit exposure, no duration risk |

| 3. Compelling Relative Value | – Loans offer one of the best yields in fixed income despite their senior secured status. |

| 4. Diversification Potential | – Low correlation with traditional asset clause. – Historically, has reduced volatility and increased returns when combined with IG fixed income. |

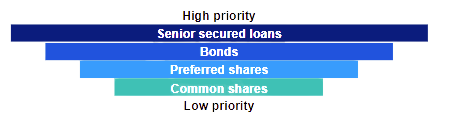

| 5. Senior Secured Status | – Highest priority to be repaid; lenders have first right to collateral in the event of a default – Higher recovery in case of default |

Senior Secured

Highest priority to be repaid; lenders have first right to collateral in the event of a default

Average ultimate recovery rates: 1987-2019

| Senior Secured Loans | 80.0% |

| Senior Unsecured Bonds | 47.0% |

| Subordinated Bonds | 26.0% |

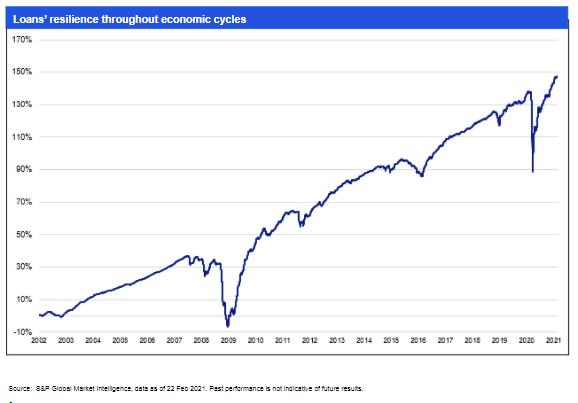

Senior secured loan’s market performance

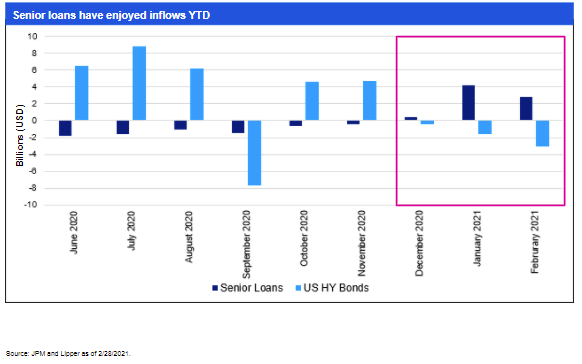

Senior loan flows have reversed